Smarter communications surveillance

With cutting-edge AI and machine learning, Smarsh reduces false positives by up to 95% and surfaces up to 5x more issues legacy technologies may have missed.

Flexible AI-powered surveillance platform

Our comprehensive, unified approach makes Smarsh a preferred choice for organizations seeking a reliable and flexible surveillance and compliance platform. Smarsh Enterprise Conduct offers a blend of regulatory compliance, flexibility, scalability, and advanced AI-powered analytics that are uniquely tailored to the complex and heavily regulated nature of the financial industry.

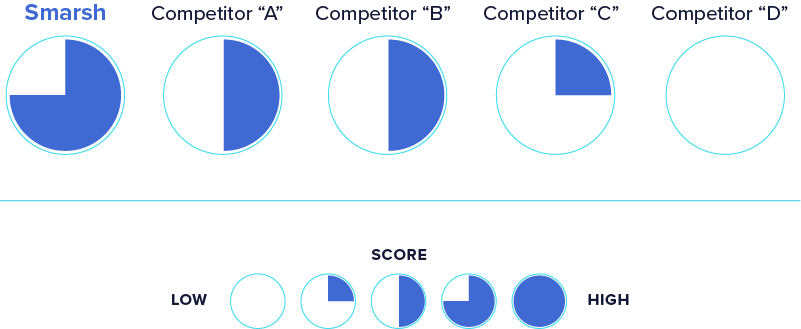

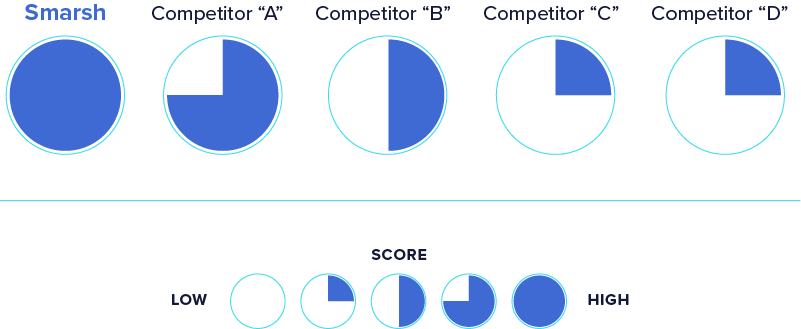

Competitive scorecard

Smarsh Enterprise Conduct vs. Competitor Surveillance Solutions

AREA OF INQUIRY

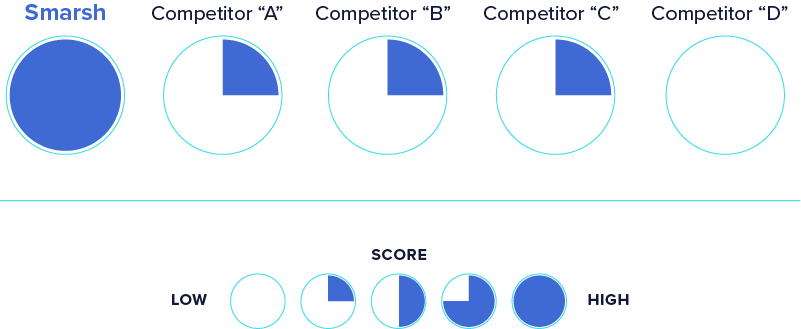

Does the organization offer a comprehensive unified solution?

Smarsh is the only organization that offers a unified communications intelligence solution.

COMPETITIVE ANALYSIS

AREA OF INQUIRY

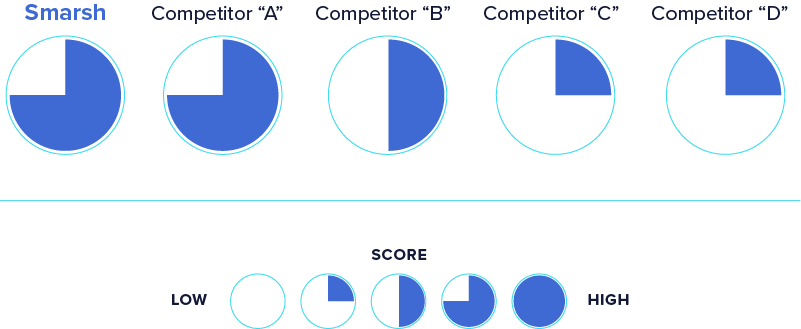

Does the solution reduce false positives and increase escalations?

Smarsh can reduce false positives by up to 95% while increasing escalations by 3-5x.

COMPETITIVE ANALYSIS

AREA OF INQUIRY

Does the solution use ML to reduce false positives and generate alerts?

Smarsh does not require complex coding or data scientists to implement risk coverage – you own your own risk.

COMPETITIVE ANALYSIS

AREA OF INQUIRY

Does the solution offer no-code configurations and customization?

Smarsh provides an easy-to-use interface to speed up risk coverage without involving complex IT processes.

COMPETITIVE ANALYSIS

AREA OF INQUIRY

Does the solution support multilingual alerting and transcription?

Smarsh and Amazon Transcribe can detect 100+ languages to generate alerts and transcribe in real time.

COMPETITIVE ANALYSIS

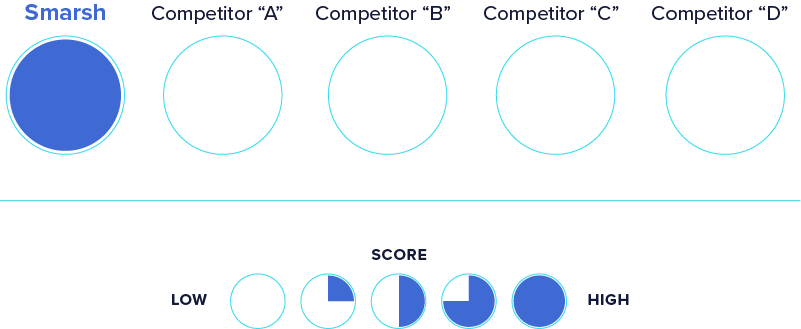

AREA OF INQUIRY

Are the ML models explainable both internally and to regulatory auditors?

With Smarsh, you can trust that the AI/ML model has and will consistently pass regulatory audits.

COMPETITIVE ANALYSIS

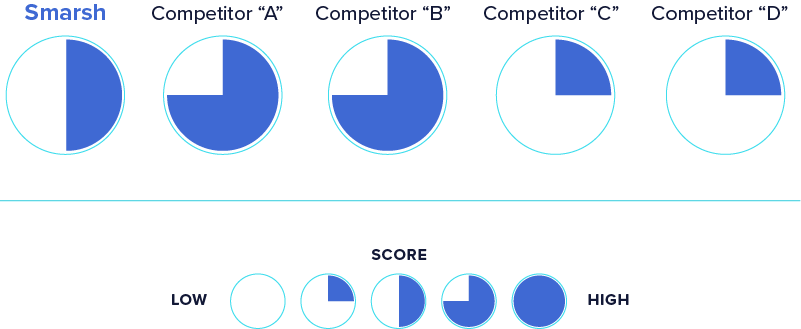

AREA OF INQUIRY

How quickly can the solution start to surface risks?

Only Smarsh delivers the fastest time to true risk identification and productivity in the market.

COMPETITIVE ANALYSIS

Why Smarsh stands out

AI & ML-driven surveillance

- Uses regulatory-grade AI and Machine Learning (ML) to detect risky behavior (e.g., insider trading, collusion, inappropriate language)

- Our AI/ML capabilities have been operational in collaboration with the world's largest financial institutions for a decade

- Can flag context-aware risks, going beyond basic keyword detection

Regulatory compliance expertise

- Smarsh is built with FINRA, SEC, MiFID II, FCA, and GDPR compliance in mind

- Supports archiving and surveillance across emails, voice, messaging, collaboration tools (Slack, Teams), and social media, which are all subject to strict regulations

- Provides transparency to board and regulators: Explain with confidence and documentation why specific measures were selected to mitigate risk — and help your firm complete and pass regulatory reviews and exams quickly with minimal disruptions

Ease of use & automation

- Provides intuitive dashboards and workflows for compliance teams

- Offers automated archiving, retention policies, and supervision reviews, which reduce manual burden

- Saves time and reduces operational costs

Proven track record with financial institutions

- Smarsh is trusted by 18 of the top banks and 95% of the top financial firms

- Recognized as a leader in Gartner and Forrester reports for archiving and supervision solutions

- Offers strong customer support and implementation services

Compliance efficiency and peace of mind

If you're running surveillance for a financial firm, Smarsh gives you compliance peace of mind, operational efficiency, and future-proof technology — all of which are critical in today’s regulatory and digital landscape.

+

Years of serving global financial services teams

%

Of the top financial firms trust Smarsh.

B+