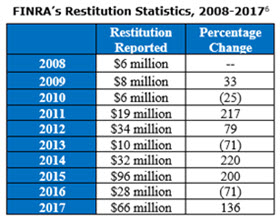

Financial Industry Regulatory Authority (FINRA) restitution more than doubled in 2017, according to Eversheds Sutherland’s annual analysis of reported disciplinary actions. FINRA reported restitution of approximately $66 million in 2017, an increase of 136% from the $28 million in restitution reported in 2016.

In 2017 FINRA fines amounted to $73 million, a 58 percent decrease from a year earlier. However, this figure is the fourth highest when compared to the last 10 years of data. Fines have increased by 161% since 2008, when FINRA assessed fines of $28 million.

“Last year, FINRA’s fines predictably decreased after 2016’s record-setting year, but the amount of restitution ordered increased, demonstrating that FINRA is interested in getting money back into the pockets of investors,” said Brian L. Rubin, Eversheds Sutherland partner and co-author of the analysis.

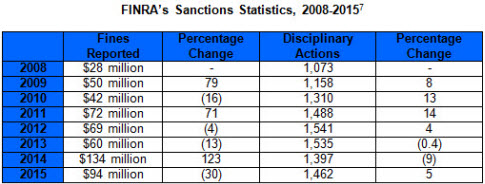

The chart below displays FINRA’s fines and the number of disciplinary actions during each of the past 10 years:

The chart below displays the restitution FINRA reported during each of the past 10 years:

Top Enforcement Issues

“FINRA addressed an array of topics in 2017, continuing its focus on anti-money laundering, while also pursuing more ‘nuts and bolts’ issues like trade reporting, record retention, and supervisory policies and procedures,” said Rubin.

Electronic communications cases resulted in the third largest amount of fines assessed by FINRA. This is the first time that electronic communications cases have been on Eversheds Sutherland’s Top Enforcement Issues list since its first-place finish in 2013. In 2017, FINRA reported $8.3 million in fines for 44 electronic communications cases. In the largest electronic communications case, a firm was fined $2 million for failing to implement a reasonable supervisory system to review emails. The firm’s “lexicon” was not reasonably designed to detect certain misconduct that the firm knew or should have anticipated would recur, and the firm failed to devote adequate personnel and resources to its review team, even as the number of emails increased over time.

Books and records cases resulted in the fourth most fines for FINRA in 2017. This is the second year in a row that this issue has appeared on Eversheds Sutherland’s Top Enforcement Issues list. FINRA reported 81 books and records cases in 2017, which resulted in $6.2 million in fines. The continued presence of books and records cases on this list was driven largely by enforcement actions against three firms primarily for failing to preserve records in a “write once, read many” (WORM) format. FINRA fined these three firms a total of $1.9 million.

Key Enforcement Trends

The dramatic increase in restitution was one of the key FINRA enforcement trends in 2017. There were nine supersized restitution orders, totaling nearly $55 million, of which three were significant restitution orders, totaling $40.4 million.

“The increase in restitution may signal that FINRA intends to order more customer remediation rather than assess punitive sanctions against firms,” said Adam Pollet, Associate and co-author of the analysis.

A new FINRA trend in 2017

Regulators also have text messaging on their mind. FINRA fined and suspended four brokers last year for unauthorized text communications with clients. Brokers will continue to be fined for using communication tools outside of their firm’s Written Supervisory Procedures (WSPs) as FINRA tightens oversight of text messaging between firms and their clients.

These recent fines are a clear indication that violations of electronic recordkeeping rules continue to be FINRA’s top priority. Even if your WSPs prohibit the use of text messaging for business communications, you can no longer assume advisors aren’t using their mobile devices to communicate with clients. For this reason, an SMS/text messaging prohibition policy is ineffective. The safest approach to comply with the electronic recordkeeping rules and regulation is to implement an “archive everything” strategy. Firms need to be aware of the electronic communications landscape and ensure they archive all business communications sent to and received by their advisors, whether those advisors communicate via email, social media, text messaging, instant messages, or other forms of electronic communication. It’s time to be proactive and stay ahead of the conversation.

- 2022 Regulatory Roundup: Record-Breaking Penalties Provide a Glimpse Into 2023 - December 28, 2022

- Smarsh Advance Recap: Voice – The Newest Frontier in Supervision - December 15, 2022

- CFTC's 2022 Enforcement Results Highlight Recordkeeping and Supervision - October 27, 2022