This article is based on the recent webinar: Must-Know FINRA Trends & the Impact on Compliance. You can watch the full webinar here.

Financial firms are experiencing a tumultuous time as technology, demographics, and communication preferences are changing how advisor-client interactions are regulated. With FINRA and the SEC forced to adapt to broadening channels of communications, firms and advisors need to re-examine their own communications governance to avoid heavy fines and sanctions.

Current Communication Trends

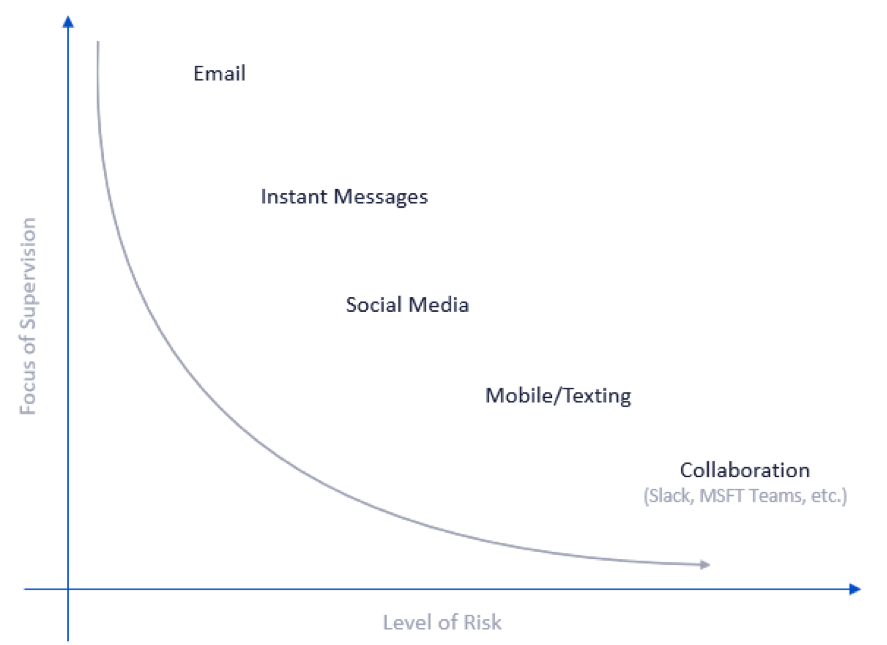

While 41% of the recent enforcement decisions were based on email communications in the past 12 months, enforcement for non-email communications like text messages, client relationship management (CRM) software, video conferencing, and cloud storage are also rising.

Firms don’t focus enough on the latest communication technologies

“It’s not just email anymore,” says Marianna Shafir, Corporate Counsel of Smarsh. “Regulators are also looking at tweets and other communication channels.”

In a regulatory first, the SEC recently fined a pair of roboadvisors $250,000 for not preserving copies of their tweets related to recommendations. On the state level, the State of Massachusetts fined a broker-dealer firm $100,000 for mishandling client information held within third-party CRM software.

Why are more firms willing explore other channels of communication? Partly because customers demand it.

Poll of communication preferences among SmarshCONNECT 2019 attendees

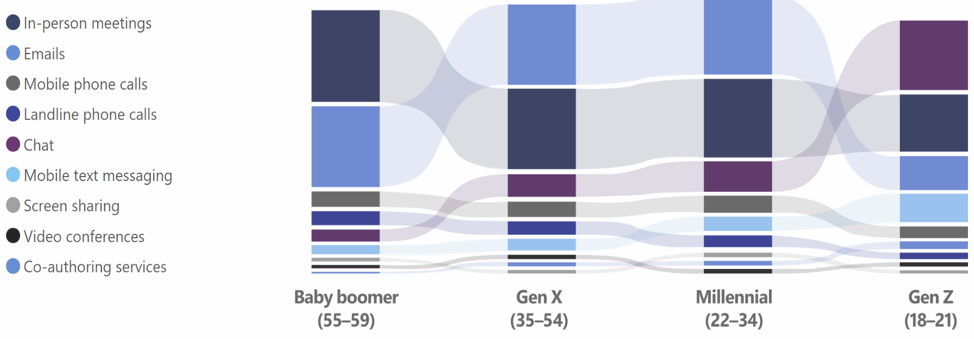

“Customers are asking reps to do business through particular communication [channels],” says Robert Cruz, Senior Director of Information Governance at Smarsh. “Gen Z [customers] may not even have an email account and may want to engage on an encrypted app or by chatting.”

One reality is that customers appreciate faster and more responsive engagement and will almost always prefer communicating over text than email. According to Gartner, text message open and response rates are as high as 98% and 45%, respectively, while email sees corresponding rates of 20% and 6%.

But what about the age demographics of the firm itself? How do the different age groups of employees affect the review policy?

“Baby Boomer and Gen X [demographics] are the profile of the typical supervisor of a firm,” says Melinda LeGaye, President of MGL Consulting. “Firms can run into issues where reps are choosing other communication channels that they think aren’t being supervised by the firm, or you have situations where the supervisors don’t even know these communication channels exist or how to use them.”

Also, advisor-client relationships develop organically and can span multiple channels. Firms are supervising what they think their reps are using as opposed to what the reps are using. This gap in supervision can put firms at serious risk.

How Can RegTech Help?

FINRA is putting increasing focus on the use of regulatory technologies (RegTech), which can capture messages across multiple channels and allow them to be monitored and reviewed in their native format.

“To be able to look at communication in their native environments is huge from both a supervision and enforcement perspective,” says LeGaye. “It’s important to see the message as it was originally created and where it was in the timeline of the events that took place. You can’t look at a message in a vacuum.”

While it's common for firms to focus on point solutions to monitor different channels, maintaining disparate systems prevent a wholistic review of multi-channel interactions.

Today’s social and collaborative technologies are dynamic, context-sensitive, and multi-dimensional. A conversation may start through social media or instant messaging, move to email and then jump to SMS text messaging—and all could be further contextualized with emojis. None of these active or interactive elements translate well into a static review environment—and too many solutions flatten this content into email for archive and review, which loses important metadata and important context.

“When you flatten those files, you break that electronic chain of custody, which can create issues during litigation” says Marty Colburn, CTO of Cloud Partners and former Executive Vice President and CTO of NASD/FINRA. “To be able to see communication in their native format and in context is very important in e-discovery as well as being able to satisfy the regulatory mission.”

However, not all RegTech solutions are created equal.

“Experience matters,” says Colburn. “You want to pick a vendor who continues to invest in their technology as the regulatory and industry landscape changes.”

Updating Your Supervisory Programs

Reviewing your firm’s communication practices is a great first step to understanding where your risks are—even before you implement a RegTech solution.

“Firms need to look at the different ways their reps are communicating,” says LeGaye. “The firm needs to adjust its policies and practices to whatever is happening within it.”

Even after implementing RegTech, it’s important to note that technology should never replace your lexicon.

“It isn’t about the lexicon going away; it’s just the opposite,” says Colburn. “The technology becomes a part of automating those written tasks and rules. If you look at it from that perspective, it lets you understand how you use this technology for compliance and to conduct your business.”

Shafir agrees. “It’s still the firm’s responsibility if they use a technology partner. These tools are meant to enhance your supervision process. You can’t rely only on those tools.”

This article is based on the recent webinar: Must-Know FINRA Trends & the Impact on Compliance. You can watch the full webinar here.

Panelists include:

Marty Colburn, Chief Technology Officer, Cloud Partners

Melinda (Mimi) G. Legaye, President, MGL Consulting, LLC

Marianna Shafir, Corporate Counsel, Smarsh

Robert Cruz, Senior Director of Information Governance, Smarsh