2024 Regulatory Enforcement: A Year of Transformation

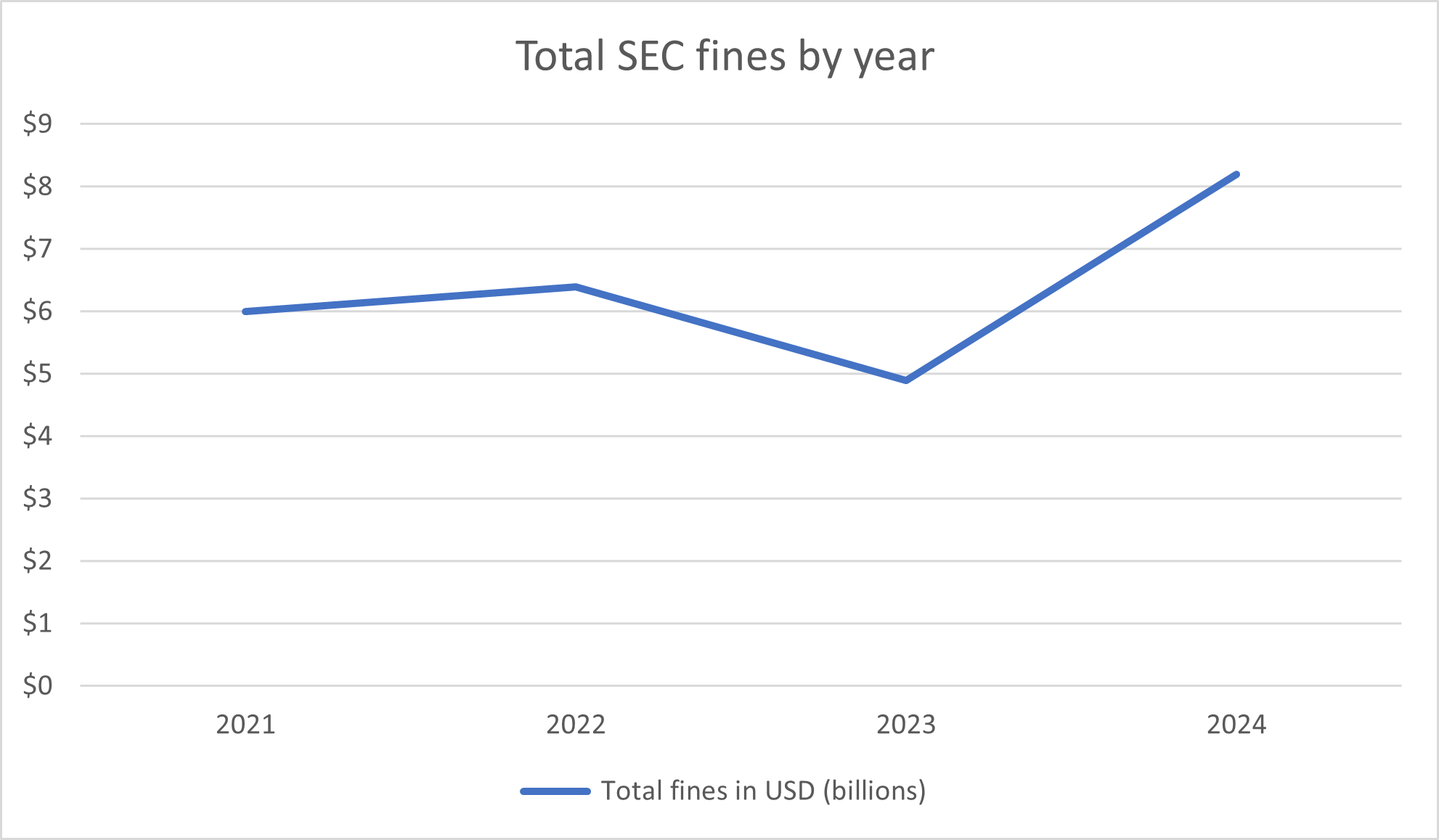

The SEC's enforcement results for fiscal year 2024 painted an interesting picture, with the Commission obtaining orders for $8.2 billion in fines and other financial sanctions — the highest amount in SEC history.

This record-breaking figure represents a 67% increase from 2023's $4.9 billion, following a period of fluctuation in recent years. The SEC had previously maintained relatively stable fine levels of $6 billion in 2021 and $6.4 billion in 2022, before seeing a 23% decrease to $4.9 billion in 2023.

Why it matters

The regulatory landscape underwent significant transformation in 2024, marked by record-breaking penalties from the SEC despite fewer enforcement actions, while FINRA took a different approach with increased case volume but lower fines. This divergence tells a compelling story about evolving enforcement strategies and priorities.

SEC regulatory activity for 2024

While 2024's dramatic increase is noteworthy, it's important to understand that approximately 56% of the total came from a single enforcement action, highlighting how individual large cases can significantly impact annual totals.

(Ever wonder where all that money goes? SEC penalties are directed to the U.S. Treasury rather than retained by the Commission. It's been reported that the SEC will likely collect little if anything of that amount.)

Watch On-demand | 2024 Regulatory Roundup: Annual Insights from Eversheds Sutherland

The year saw the SEC file 583 total enforcement actions, representing a 26% decline from 2023 and marking the lowest figure in the past decade (although the number of actions has been decreasing over the last few years). Breaking this down further reveals some interesting patterns. The Commission brought 98 actions against broker-dealers, a 30% decrease from the previous year's 140 cases. Meanwhile, combined actions against investment advisers and investment companies totaled 135, showing only a slight 3% decrease from 2023.

| Year | Total actions | YoY% change |

|---|---|---|

|

2021 |

697 |

-- |

|

2022 |

760 |

+9% |

|

2023 |

784 |

+3% |

|

2024 |

583 |

-26% |

FINRA regulatory activity for 2024

FINRA's enforcement approach told a different story. As Max Miseyko of Eversheds Sutherland explained:

"From the start of 2024 through the end of September, FINRA brought 389 enforcement cases, up from 282 during the same period in 2023. This represents roughly a 38% increase."

However, despite the increased volume, FINRA assessed only $37 million in fines through September, putting them on pace for approximately $56 million for the year. This is a significant decrease from 2023's total fines of $89 million. Looking at historical trends, FINRA's enforcement activity has shown moderate fluctuations over recent years, with cases ranging from 435 in 2021 to 465 in 2022, before dipping to 421 in 2023. Fine amounts have similarly oscillated between $57 million in 2021 and $89 million in 2022, followed by a decrease to $45 million in 2023.

| Year | Total fines | Fines: YoY% change | Cases | Cases: YoY% change |

|---|---|---|---|---|

|

2021 |

$57M |

-- |

435 |

-- |

|

2022 |

$89M |

+56% |

465 |

+7% |

|

2023 |

$45M |

-49% |

421 |

-9% |

|

2024 |

$56M (projected) |

+24% (projected) |

520 (projected) |

+24% (projected) |

While this contrasts with SEC’s actions, this structure ensures that enforcement isn't driven by revenue generation but rather by regulatory objectives.

Off-channel communications: A tale of two approaches

One of the most notable enforcement themes of 2024 was the continued focus on off-channel communications, with the SEC and FINRA taking markedly different approaches.

The SEC maintained its aggressive stance, assessing over $600 million in civil penalties against more than 70 firms, including the first cases against municipal securities advisors. Since launching this initiative in December 2021, the Commission has brought charges against over 100 firms and collected more than $2 billion in penalties.

However, a significant shift in approach may be on the horizon.

"With the new administration, if we are correct that they're not going to be bringing these kinds of cases, we may see fewer firms self-reporting without that spotlight,” said Brian Rubin, Co-Head of Securities Enforcement Practice Chair at Eversheds Sutherland. “On the other hand, it's possible that the SEC may make clear that if you self-report and meet these certain criteria, it’s not going to bring cases. Or it may bring cases, but there won't be a penalty assessed."

The decision to self-report remains complex, with firms needing to carefully weigh various factors. As Rubin explained:

"Firms need to assess the issue by scoping out how material their apparent violations are. Some firms weigh the likelihood of an enforcement action if they do self-report versus the likelihood of flying under the radar if they don't self-report, factoring in how big the issue is."

For broker-dealers specifically, FINRA Rule 4530 requires self-reporting in certain circumstances, though the standards can be vague and firms may interpret them differently.

Constitutional challenges and regulatory authority

The year also saw significant challenges to regulatory authority, particularly through several landmark court decisions. The Supreme Court's ruling in Loper Bright Enterprises overturned the 40-year-old Chevron deference precedent, potentially reshaping how courts interpret agency regulations.

Additionally, in SEC v. Jarkesy, the Supreme Court's decision requiring jury trials for SEC civil penalty cases marked a significant shift in enforcement procedure. These decisions could fundamentally alter how regulators pursue cases, potentially leading to longer timelines, increased costs, and a preference for settlements over contested actions.

FINRA faced its own challenges, with a notable U.S. Court of Appeals for the DC Circuit decision granting a preliminary injunction that questioned FINRA's expedited hearing rules.

"I anticipate we will continue to see challenges in federal court about FINRA's jurisdiction and we'll just have to see how they play out," explained Rubin.

The path forward in 2025

The enforcement landscape of 2024 suggests a regulatory environment in transition. While both the SEC and FINRA maintained strong enforcement programs, their divergent approaches to case volume and penalties indicate potentially different philosophies about achieving compliance. The rise in constitutional challenges and potential shifts in administrative procedures add another layer of complexity to this evolving landscape.

As we move forward, firms should take note of these trends and ensure their compliance programs are robust, particularly in areas receiving heightened scrutiny. The year's enforcement actions demonstrate that regulators remain focused on protecting investors and maintaining market integrity, even as their methods and approaches continue to evolve.

Share this post!

Smarsh Blog

Our internal subject matter experts and our network of external industry experts are featured with insights into the technology and industry trends that affect your electronic communications compliance initiatives. Sign up to benefit from their deep understanding, tips and best practices regarding how your company can manage compliance risk while unlocking the business value of your communications data.

Ready to enable compliant productivity?

Join the 6,500+ customers using Smarsh to drive their business forward.

Subscribe to the Smarsh Blog Digest

Subscribe to receive a monthly digest of articles exploring regulatory updates, news, trends and best practices in electronic communications capture and archiving.

Smarsh handles information you submit to Smarsh in accordance with its Privacy Policy. By clicking "submit", you consent to Smarsh processing your information and storing it in accordance with the Privacy Policy and agree to receive communications from Smarsh and its third-party partners regarding products and services that may be of interest to you. You may withdraw your consent at any time by emailing [email protected].

FOLLOW US