SEC 2019 Annual Report: Increase in Enforcement Actions and Penalties

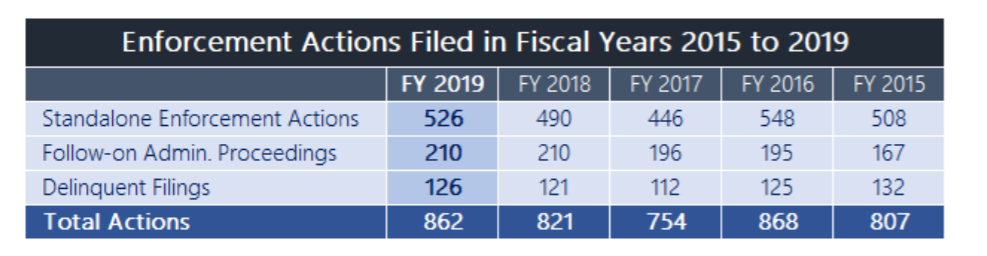

The Securities and Exchange Commission (SEC) Division of Enforcement published its annual report for fiscal year 2019. The report shows it brought 862 enforcement actions, obtained $4.3 billion in disgorgement and penalties, and returned $1.2 billion to harmed investors, with the last two totals representing the most for those categories since fiscal year 2015.

The SEC filed a total of 862 enforcement actions in 2019. The number of enforcement actions has remained steady over the last 5 years, with the exception of a record-high 2016, when the SEC brought 868 cases. Last year they filed 821 enforcement cases, and 754 the year prior, in 2017.

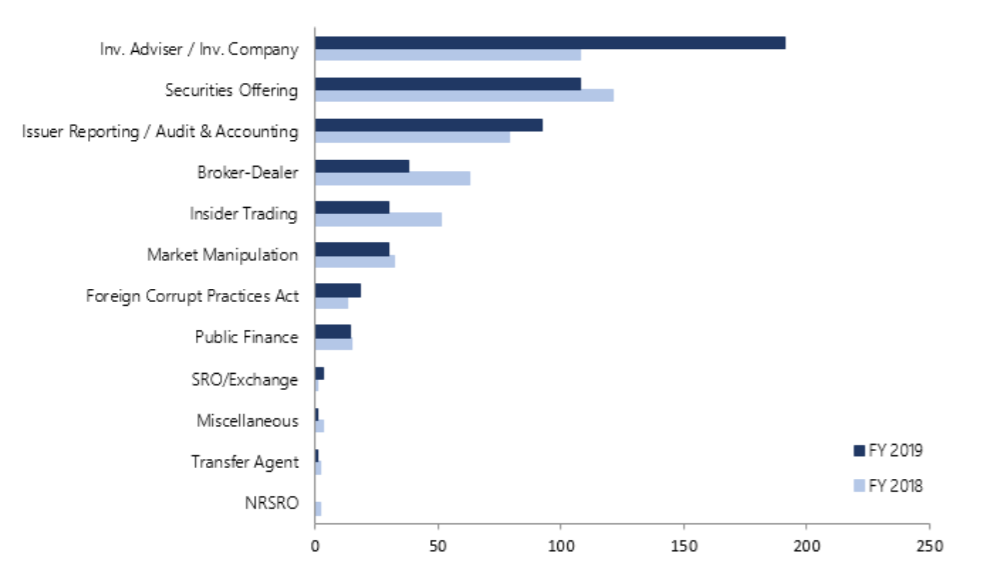

Agency takes most actions against investment advisers and investment companies

The largest group of cases involved investment advisers and investment companies. As the chart below illustrates, consistent with the prior fiscal year, the majority of the SEC’s 526 standalone cases in 2019 concerned:

• investment advisory and investment company issues (36%),

• securities offerings (21%),

• issuer reporting/accounting and auditing (17%) matters.

The SEC also continued to bring actions relating to:

• broker-dealers (7%),

• insider trading (6%),

• market manipulation (6%),

• others including FCPA (3%) and public finance (3%).

“The results depicted in this report reflect the division’s focus on rooting out misconduct that can do significant harm to investors and our markets, and the focus the division places on identifying wrongdoing and taking prompt action to effectively help harmed investors,” said SEC Chairman Jay Clayton.

Noteworthy SEC Recordkeeping and Supervision Fines in 2019

The SEC charged Walmart with violating the Foreign Corrupt Practices Act (FCPA). The retail giant has agreed to pay about $282 million to settle bribery charges. Walmart consented to the SEC’s order, finding that it violated the books and records and internal accounting controls provisions of the Securities Exchange Act of 1934.

According to the SEC’s order, Walmart failed to sufficiently investigate or mitigate certain anti-corruption risks, and allowed subsidiaries in Brazil, China, India and Mexico to employ third-party intermediaries who made payments to foreign government officials without reasonable assurances that they complied with the FCPA. The SEC’s order details several instances when Walmart planned to implement proper compliance and training only to put those plans on hold or otherwise allow deficient internal accounting controls to persist, even in the face of red flags and corruption allegations. “Walmart valued international growth and cost-cutting over compliance,” said Charles Cain, chief of the SEC Enforcement Division’s FCPA Unit. “The company could have avoided many of these problems, but instead Walmart repeatedly failed to take red flags seriously and delayed the implementation of appropriate internal accounting controls.”

The SEC fined a marketplace lender $3 million for miscalculating and materially-overstating annualized net returns to retail and other investors. According to the SEC order, from approximately July 2015 until May 2017, the lender in question excluded certain non-performing charged-off loans from its calculation of annualized net returns that it reported to investors. As a result, the firm reported overstated annualized net returns to more than 30,000 investors through individual account pages of its website, and in emails soliciting additional investments. Many investors decided to make additional investments based on these overstated annualized net returns.

Also this year, the SEC and Tesla Chief Executive Officer (CEO) Elon Musk reached an agreement over the CEO’s use of social media. The settlement requires all of Musk’s communication about Tesla’s business via social media, the company’s website, press releases, and investor calls to be preapproved by a securities lawyer. The agreement follows an August 2018 tweet from Musk saying he had obtained the funding necessary to take Tesla private at $420 per share. This violated a previous agreement that Musk was supposed to seek approval before tweeting material information about Tesla. The SEC then went back to court to establish clearer rules for Musk’s public communications. Their settlement required Musk to step down as the chairman of Tesla’s board of directors for three years, pay a $20 million fine, and seek approval prior to publishing all future communications that could be relevant to Tesla shareholders.

The data shows enforcement was a top priority for the SEC in 2019, even with a government shutdown and a change in administration. Companies should expect that the SEC won't tolerate inadequacy or indifference to compliance in the year ahead as well.

Share this post!

Archiving and Compliance Blog

Our Blog explores the news, trends and best practices in electronic recordkeeping. It’s about managing and getting value from your electronic communications data. It’s about satisfying legal and regulatory obligations. It’s all about turning compliance liability into business insight.

Subscribe to the Smarsh Blog Digest

Subscribe to receive a monthly digest of articles exploring regulatory updates, news, trends and best practices in electronic communications capture and archiving.

Smarsh handles information you submit to Smarsh in accordance with its Privacy Policy. By clicking "submit", you consent to Smarsh processing your information and storing it in accordance with the Privacy Policy and agree to receive communications from Smarsh and its third-party partners regarding products and services that may be of interest to you. You may withdraw your consent at any time by emailing privacy@smarsh.com.

FOLLOW US