Related WebinarSmarsh recently hosted a webinar with Eversheds Sutherland LLP to discuss their results: FINRA’s Fines and Sanctions Hit Record High in 2016

|

FINRA fines hit record levels in 2016, according to an annual analysis of FINRA disciplinary actions released by the law firm Eversheds Sutherland (US) LLP.

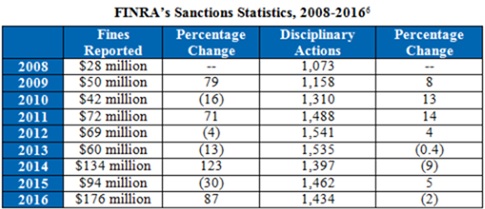

The fines reported by FINRA in 2016 increased dramatically to a record-high of $176 million, an increase of 87% from the $94 million reported in 2015, and a 31% increase from the former record of $134 million in 2014.

Overall, fines have increased by 529% since FINRA assessed fines of $28 million in 2008!

“Last year FINRA continued its trend of ordering significant fines, shattering its previous record set in 2014,” said Brian L. Rubin, Partner at Eversheds Sutherland. “If firms and their representatives weren’t paying attention to this trend, they should be now,” said Rubin. “Although some have speculated a reduction in the Securities and Exchange Commission’s Enforcement program with the new administration, FINRA shows no signs of slowing down.”

The chart below displays the fines and the number of disciplinary actions FINRA reported during each of the past nine years:

In its analysis, Eversheds Sutherland also identified FINRA’s top enforcement issues and emerging trends in 2016, measured by total fines assessed.

Top Enforcement Issues

Top enforcement issues included cases related to anti-money laundering, variable annuities, trade reporting, books and records, and unregistered securities.

Books and records cases resulted in the fourth most fines for FINRA in 2016, and it was the first time the issue appeared on Eversheds Sutherland’s Top Enforcement Issues list. FINRA reported 99 books and records cases in 2016, resulting in $22.5 million in fines. Compared to 2015, that represents a 423% increase in fines related to books and records.

Eversheds Sutherland notes this sudden change in books and records cases was driven largely by enforcement actions against 12 firms for, among other things, failing to preserve records in “write once, read many” (WORM) format.

Key Enforcement Trends

Eversheds Sutherland said the explosive increase in fines was the key FINRA enforcement trend in 2016, with fines jumping to $176 million. The increase was principally due to the significant rise in the size and number of what the firm calls “supersized” fines of $1 million or greater, and “yuuuge” fines of $5 million or greater.

Eversheds Sutherland said this trend signals that FINRA will continue to assess substantial fines against firms even where there’s limited or no measurable harm to customers.

FINRA also cracked down on individual compliance officers in 2016. Twenty-seven cases involved sanctions against a firm’s compliance officer. In many cases, the compliance officers “wore many hats” and “acted in other capacities such as firm president or chief executive officer.”

“These cases are a signal to compliance officers that they are in FINRA’s crosshairs,” said Rubin. “They ought to take heed and try to ensure that adequate compliance-related policies and procedures are in place.”

The Eversheds Sutherland report is a clear indication that issues discovered cost firms more than they ever have before. Specifically, the Books and Records rule continues to be a top concern for the regulators.

FINRA will continue to focus on firms’ compliance with their supervisory and record-retention obligations. These obligations apply to all electronic communication channels, irrespective of the medium or device used to communicate according to FINRA's 2017 Priorities Letter. This means firms must archive all business communications, including email, social media, text messaging, websites, or other forms of electronic communication. Also, firms cannot assume their advisors won’t use their smartphones or social media accounts to communicate with clients, even if a firm prohibits such communications via policy and written supervisory procedures. Best practice is to implement an archive everything strategy to comply with FINRA requirements and avoid costly fines and penalties.

For the full FINRA fines annual analysis by Eversheds Sutherland, click here.

- 2022 Regulatory Roundup: Record-Breaking Penalties Provide a Glimpse Into 2023 - December 28, 2022

- Smarsh Advance Recap: Voice – The Newest Frontier in Supervision - December 15, 2022

- CFTC's 2022 Enforcement Results Highlight Recordkeeping and Supervision - October 27, 2022

FEATURED CONTENT

Digital Communication Archives Aren't Just for Compliance Anymore: 10 Powerful Archive Use Cases

ARCHIVING & COMPLIANCE BLOG

Our Blog explores the news, trends and best practices in electronic recordkeeping. It’s about managing and getting value from your electronic communications data. It’s about satisfying legal and regulatory obligations. It’s all about turning compliance liability into business insight.